Rune Allnor wrote:>> ... DSP techniques applied *properly* to financial data -- >>say, to remove noise from long-term trends that do exist -- can >>be useful. > > > I see acontradiction here. A few lines up you say that standard statistical > tools don't apply to financial analysis. Here you say that DSP techniques > can be used for financial analysis. To me, DSP techniques are nothing > more than specially tailored statistical techniques that rely on standard > statistical analysis (mean, standard deviation, variance) and that in > 95% of all cases are based on assumptions about the system being Gaussian. > > I think you might have answered your own question here.It's not an answer if he doesn't want it to be.>>The successful commodity traders I have encountered >>don't waste their time trying to make predictions; instead they >>*anticipate* certain behaviors based on past history. > > > What would be the difference between "predict" and "anticipate"?A prediction is a statement about the future. Anticipation is action in advance of an event. A prediction can be shown to have been wrong. An action taken in anticipation of an event can be ascribed to whatever motive seems convenient and plausable after the fact. If "predict" and "anticipate" are not merely distinctions without a difference, the difference must be that anticipating is a bit less likely to lead to embarrassment.> The basic difference between a good and a bad trader would be that, > given the same information about the market, the good trader understands > the psychology of the market, and understands how other actors will > react every time he recieves new pieces of information. A DSP chip can't > replicate that.Actually, I don't see why not. ... Jerry -- Engineering is the art of making what you want from things you can get. �����������������������������������������������������������������������

Designing Filters with non-uniform sampling

Started by ●July 27, 2004

Reply by ●July 31, 20042004-07-31

Reply by ●July 31, 20042004-07-31

axlq wrote:> In article <410ac405$0$2815$61fed72c@news.rcn.com>, > Jerry Avins <jya@ieee.org> wrote: > >>dnb is probably aware that Bob has a lively interest in the stock market >>-- he is the moderator of an informal investment group on the web -- and >>I assumed his comment to be of the "in case you're wondering" kind. > > > Ah. Okay. Chalk it up to me not being familiar with who's who around > here.... > > -AI imagine that very few people here knew that. It's a fine example of how assumptions that seem eninently reasonable can turn out to be entirely wrong. Life is too short to let us check every assumption, so we do that sort of thing often. Jerry -- Engineering is the art of making what you want from things you can get. �����������������������������������������������������������������������

Reply by ●July 31, 20042004-07-31

Jerry Avins <jya@ieee.org> wrote in message news:<410bb04d$0$2826$61fed72c@news.rcn.com>...> Rune Allnor wrote: > > >> ... DSP techniques applied *properly* to financial data -- > >>say, to remove noise from long-term trends that do exist -- can > >>be useful. > > > > > > I see acontradiction here. A few lines up you say that standard statistical > > tools don't apply to financial analysis. Here you say that DSP techniques > > can be used for financial analysis. To me, DSP techniques are nothing > > more than specially tailored statistical techniques that rely on standard > > statistical analysis (mean, standard deviation, variance) and that in > > 95% of all cases are based on assumptions about the system being Gaussian. > > > > I think you might have answered your own question here. > > It's not an answer if he doesn't want it to be.That would depend entirely on what "hat one wears". An engineer would hopefully accept failing prerequisits as the reason for why a given method doesn't work. An economist might not. And all too often does not.> >>The successful commodity traders I have encountered > >>don't waste their time trying to make predictions; instead they > >>*anticipate* certain behaviors based on past history. > > > > > > What would be the difference between "predict" and "anticipate"? > > A prediction is a statement about the future. Anticipation is action in > advance of an event. A prediction can be shown to have been wrong. An > action taken in anticipation of an event can be ascribed to whatever > motive seems convenient and plausable after the fact. If "predict" and > "anticipate" are not merely distinctions without a difference, the > difference must be that anticipating is a bit less likely to lead to > embarrassment.So "It will come snow next winter" is a prediction while "I wouldn't be surprised if snow falls next winter" is an anticipation? I could go along with that anticipation is a slightly less certain expression of clairvoyance than right-out prediction.> > The basic difference between a good and a bad trader would be that, > > given the same information about the market, the good trader understands > > the psychology of the market, and understands how other actors will > > react every time he recieves new pieces of information. A DSP chip can't > > replicate that. > > Actually, I don't see why not.Eh... well, I said "good trader", not "successful trader". The successful trader would most likely be the one that gets more information earlier than others. With this distinction, the DSP might very well replicate the success of the merely good trader...> JerryRune

Reply by ●July 31, 20042004-07-31

Rune Allnor wrote: ...>>>The basic difference between a good and a bad trader would be that, >>>given the same information about the market, the good trader understands >>>the psychology of the market, and understands how other actors will >>>react every time he recieves new pieces of information. A DSP chip can't >>>replicate that. >> >>Actually, I don't see why not. > > > Eh... well, I said "good trader", not "successful trader". The successful > trader would most likely be the one that gets more information earlier > than others. With this distinction, the DSP might very well replicate the > success of the merely good trader...If the market typically reacts a certain way to certain information, even a neural net could learn to anticipate the reaction. I don't see that knowing the motivation for the market's behavior is especially relevant. Jerry -- Engineering is the art of making what you want from things you can get. �����������������������������������������������������������������������

Reply by ●August 3, 20042004-08-03

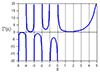

axlq@spamcop.net (axlq) wrote in message news:<cee658$9ol$1@blue.rahul.net>...> In article <f56893ae.0407300324.1fcb45fc@posting.google.com>, > Rune Allnor <allnor@tele.ntnu.no> wrote: > >axlq@spamcop.net (axlq) wrote in message news:<cecpt1$f99$1@blue.rahul.net>... > >> So what's the problem? Shed some light please. > > > >The problem, as I see it, is that financial data are completely random, > >while "classical" DSP problems (i.e. applications in communications or > >physics) have to obey some underlying system. > > I guess that would be a problem, if financial data were completely > random. Completely random financial data would have the same > statistical character as a random walk -- i.e. the distribution > of returns are gaussian. > > The fact that financial data *doesn't* exhibit this gaussian > characteristic implies that some determinism is taking place, an > idea embodied by the Fractal Market Hypothesis (FMH) contradicting > the traditional Efficient Market Hypothesis (EMH) which posits > random walks. The fact that the distributions aren't gaussian > (more like "stable paretian" having a variance of infinity) renders > worthless all the usual statistical analysis techniques one would > apply (standard deviation and the like) but that's another subject > entirely. Anyway, the distribution exhibited by markets implies > that market trends will last longer than with a random walk, and > that a market will be prone to large dramatic moves more often. > > That said, DSP techniques applied *properly* to financial data -- > say, to remove noise from long-term trends that do exist -- can > be useful. The successful commodity traders I have encountered > don't waste their time trying to make predictions; instead they > *anticipate* certain behaviors based on past history. DSP simply > provides some tools with which to build a strategy; DSP isn't *the* > think these traders use to make decisions. > > >One knows, for instance, that a communications link will have > >certain statistical properties and that these properties will > >be more or less stable when the link is in use. One knows that > >certain targets will stay in a combat theatre, and move smoothly > >under the laws of physics, until they leave or are destroyed. A > >688 class sub will move differently than an F22 raptor, but both > >move within their respective physical limits which are constant. > > This is where things get interesting, and my field of employment > (defense) potentially overlaps the financial analysis field. > > There are cases where a target is unknown, the dynamics of the > target cannot be modeled or assumed in advance, and the target is > capable of deliberate erratic movements with accelerations so great > that they resemble elastic collisions, AND the sensor tracking the > target has to contend with positioning errors due to atmospheric > disturbances and other sources of noise. > > This is exactly the problem faced by designers of filters for market > data, only the financial data is a 1-dimensional time series whereas > the tracking problem has 2 or 3 dimensions. In fiancial terms, the > problem could be stated as "how do I track the true long-term price > movements of this instrument amid all the short-term variations > (noise), smoothing the trends yet maintaining the high-frequency > component of the signal at turning points?" The target tracking > problem is basically the same: "How do I accurately track the motion > of a target that has occiasional high-frequency components in its > motion, while filtering out the high-frequency positioning errors?" > > Mark Jurik's JMA filter is probably the best thing I've seen in > the "financial DSP" arena, but it's a proprietary algorithm. In > my spare time I'm coming up with ways to reverse-engineer it. I > do know that JMA isn't a spectral filter; it's more distribution > based, maintaining a measurement of filter error relative to a > measurement of signal noise and somehow adapting the smoothing > power accordingly. The result is something that can follow step > functions with almost no overshoot and yet maintain attenuation of > the high frequencies that are really present within the signal. > > See the noisy sawtooth signal at the bottom of > http://www.jurikres.com/down/why_jma.pdf and also the noisy > sawtooth and noisy step function response at the bottom of > http://www.jurikres.com/down/ma_evolv.pdf -- Pretty cool, if you ask > me. > > -AYou may want to look at Interacting Multiple Models (IMM). Essentially you can look at the innovations and decide when to modify the model. This corresponds to tracking targets that tend to move in straight lines (constant velocity) and then perform some maneuvre. Cheers, David