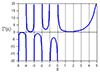

I am concerned with stock market data. It is described as nonstationary pink noise. It can be reasonably represented as an exponential moving average of white noise. My question is whether this band limited data can better be modeled as phase noise (data = Sin(wt + N(t)) ) or as amplitude noise (data = N(t)*Sin(wt) )? How would one go about making the determination? If it is a mixture, how would one go about separating the models?

You might want to read this: https://www.scientificamerican.com/article/multifr... which is closer to modeling the properties of the stock market. Wavelet analysis does a much better job than Fourier analysis simply because of the way humans react to things (like coronovirus which is monkey wrench for any method of analysis). We also repeat ourselves a lot, which is the point of wavelets.

For most things I find Fourier analysis very useful and wavelets not so much. But for the stock market, it works amazingly well.

Dr. Mike-

Great reference and article by Mandelbrot himself. As applicable now as it was in 1999 and 2008.

-Jeff

Well, your proposed data model might work better if you extend it to be a sum of the sinusoids. In any case, you have to estimate the parameters (w and the noise variance), Afterwards compare the error variance, the less the better. Also, you might want to check if the error (as a process) is white.

I hope you decided to sell right after you made this post.